Cryptocurrencies have dominated global news headlines in the last eight months as the market swung between highs and lows. Despite emerging from the periphery of the digital age a few years ago, cryptocurrencies now occupy the centre stage of global discourse. On the Internet, in workspaces, schools, and other areas of human activity, interest in the wonder coins has stunningly rocketed.

Along with the fame of cryptocurrencies have emerged tangible outcomes, impact, and effects on related fields of human endeavour. Whether it is the resurgence in money making tips or launch of initial coin offerings, a pattern can be deciphered. There are applications previously unknown, and protocols that have sprung to life because of cryptos.

The overwhelming effect of cryptocurrencies on the global economy, as well as the banking and finance sectors, is unravelling. What will be the next cryptocurrency of choice? Will Bitcoin exchange rate to the dollar soar as it did in 2017? These are some of the contemplations many people around the globe are faced with today.

Let us look at some of the impact and touchstones of cryptocurrency in our world:

Boost in Business

The global business scene has recorded an influx of cryptocurrency-related businesses. Exchanges, app developers, documentation specialists, software engineers, graphic designers and website developers have all got a piece of the pie.

The cumulative effect of cryptocurrencies on the specialists mentioned above is a business boost that has led to more inflows. This is remarkable for the hitherto unknown Bitcoin to give rise to a multi-billion dollars industry. The search for cryptocurrencies and related themes has become prominent in search engines with the mounting global scramble for crypto profit-taking.

Almost all countries on earth have been impacted in form or the other by the rage of Bitcoin, and the altcoins. The exception will be countries like China, South Korea, and India, where there has been a restriction on Bitcoin trade

In terms of regulatory agencies, increased activities have also arisen with tax agencies scrambling to get abreast of the income possibilities. Technical competence in terms of training for operators of the financial sector should also be identified as an impacted field. This is as development and dissemination of the body of knowledge in cryptocurrency is still evolving.

Increase in Banking Activities

Banking activities capture all the processes of receipts and payments on the global scale. Many transactions are executed daily in the course of business. With cryptocurrency transactions joining the existing trail of transactions, banking activities certainly spiked.

Cryptocurrency exchanges accept different payment options and the funds get funnelled through the banks in most cases. With transactions in cryptos hitting a daily height of $18 billion globally, the surge in banking transactions is immense. The highest peak of transactions was recorded in December 2017, and it was $28 billion.

The growth in the number of crypto exchange operators means that more people are able to trade in cryptocurrencies. As people buy and sell their tokens and coins, the net effect is a boost in banking activities.

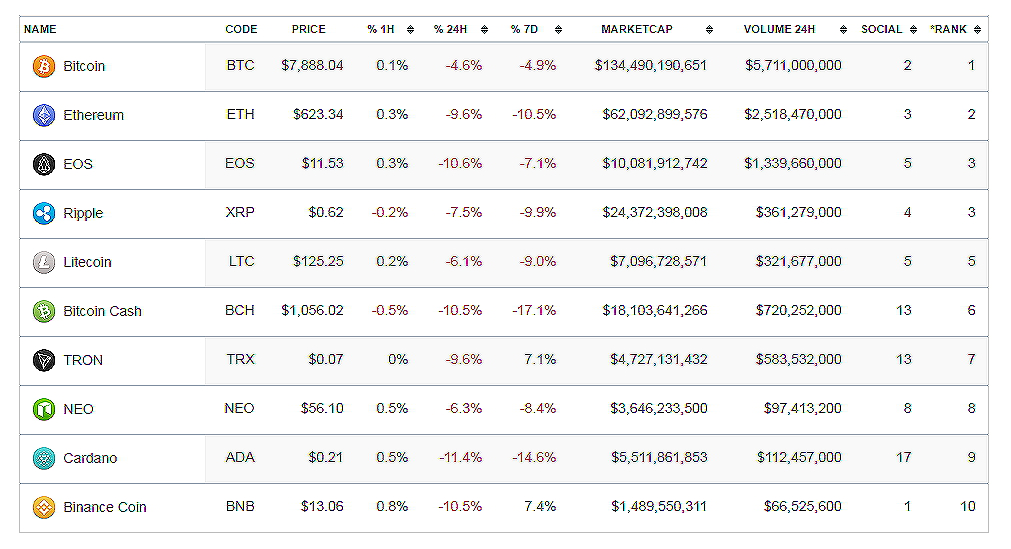

Here is a snapshot of the leading cryptocurrencies by daily trade volumes from the coin market cap database. Bitcoin value is at a commanding height:

Reduction in Savings Accounts

Trading in cryptocurrencies can yield returns from 10% to 20,000% as seen in Bitcoin price volatility in 2017. Bitcoin produced a stunning return rate when it peaked at $18,737 on December 18, 2017, from $930 a year earlier. Bitcoin price projections might have fallen short of the remarkable heights of 2017, but it still shows some promise.

[Coinmarketcap Image]

The returns on Bitcoin for buyers of the wonder coin have shown a remarkable capacity for value-addition. The performance indices for most of the altcoins rival the sterling display of Bitcoin in the past year. On this basis, many savings account holders would rather buy Bitcoin and wait for a price surge than keep it in bank vaults.

Bitcoin has consistently outperformed the returns on a savings account, and there is no doubt that it is a better option. While risk-averse investors might leave their funds in bank savings, the daring ones would dare the risk. In the marketplace of investment opportunities, greater risk yields higher returns.

While the impact of cryptocurrency trading on savings accounts is not yet documented, it is worth reviewing. When funds are channelled into coins and tokens, there might be a reduction in the volume of savings accounts. However, since fiat money is used to buy cryptocurrencies, it ends up in the current or investment accounts.

Purchasing Power Boost

The purchasing power of anyone would rise when there is an increase in earnings. Purchasing power is, therefore, a function of income and the related expenses or commitments against it. As a global rule, an increase in earnings or income will give a boost to the purchasing power of the individual.

Since cryptos give rise to better earnings for investors, there is no doubt that they make a difference. This is a remarkable feature that a candid observer of the trade in coins and tokens will readily recognize. Many people who were able to put some money away for crypto trade saw leaps in their disposable income for 2017.

As far as the personal economy is concerned, a rise in cash at hand would make anyone spend more. It could translate to more investment, new acquisitions, a change of wardrobe or a new endeavour, etc.

Boost to Global Wealth

Individuals make up a community; communities make up a province, city, state or region. When communities are aggregated, a nation emerges. In simple terms, when personal wealth increases in a country, the country gets wealthier. As nations prosper, the global wealth indices also rise.

In many countries across the globe, trading cryptocurrencies was a phenomenal avenue to make money in 2017. What this produced was a palpable leap in income for crypto investors as well as a rise in disposable income. For residents of most nations, earnings made from crypto trade are taxable as capital gains tax or earnings tax.

As a nation gets more revenue from tax paid by her citizens, there is an increase in the National Income, and by extension, expenditure funding. When funding is directed at productive sectors, there is value-addition and wealth creation. This is the tangible fallout of the rise of cryptocurrencies.

Transactional Efficiency

Transactional efficiency across payment fronts has emerged with some revolutionary tools becoming widespread. Crypto technologies have produced a remarkable reduction in the cost of money transfer transactions. Ripple provides huge savings for banks when used for money transfers.

The efficiency of cryptocurrency money transfers on the Ripple platform gave rise to instantaneous global money transfers. On the Dogecoin platform, small payments are enabled as people offer tips online and across social media channels. Before the introduction of cryptocurrencies, these transaction layers were burdensome to contemplate.

To consider the difference made by cryptocurrencies in the terms of small and micropayments is a tacit admission of their utility. What’s more? Cryptocurrencies enable the concept of a global village that runs on the structure of the Internet. Spaces, borders, distance and time makes no difference when cryptos are transferred between parties.

While older algorithms used for some cryptocurrencies led to transaction delays, enhanced modules like the Blockchain 3.0 and 4.0 are different. Speed is assured in transaction processing, safety is improved, and the cost is minimized. These are the metrics that gave rise to Bitcoin Cash, and the likes of Lightning Network are taking it further.

Borderless Economies

There are several Blockchain applications that are built on a business model that assumes a borderless world. Such perception is what is seen in the likes of Populous, which discounts invoices on the Blockchain. Other examples include WePower, which leverages on the Blockchain to provide green energy.

Many facets of Blockchain payment systems thrive on tokens and coins, which are the underlying value drivers. As at last count, more than 1,000 tokens and coins are available in the crypto marketplace. Many cryptocurrencies are issued for online gaming, and others for tangible applications like data storage, Banking, Real Estate, etc.

Many Blockchain innovations are founded on the belief that the underlying tokens are of global reckoning. Business thinking of this sort means that there is no exclusion as to how the tokens and coins can be used. As long as anyone who holds cryptocurrencies can find a merchant who supports Blockchain payments, no worries will arise.

Boost to Entrepreneurial Drive

That there is a massive boost to entrepreneurial drive with the emergence of cryptocurrencies and the Blockchain is indisputable. The likes of EOS, BitShares, IOTA, and a host of others provide a backbone for other business to thrive on. Access to the Blockchain is guaranteed when apps are built on these aforementioned platforms.

Unlike in the years gone by when setting up a business could mean starting from the scratch, today’s world functions differently. Business ideas can translate to real apps when they fulfil a need. As long as the Blockchain enables an app that is token or coin-driven, cryptocurrencies will still be useful.

The far-reaching effects of cryptocurrencies have opened a new vista of opportunities for wealth creation across the globe. As process improvements are made to the Blockchain, cryptocurrencies will find more use cases with a lasting and tangible impact.